7 Loan Officer Compensation Plans

At Clear, we wake you out of the matrix. We let you choose your compensation plan in accordance to where you want to price your rates, and lock your loans.

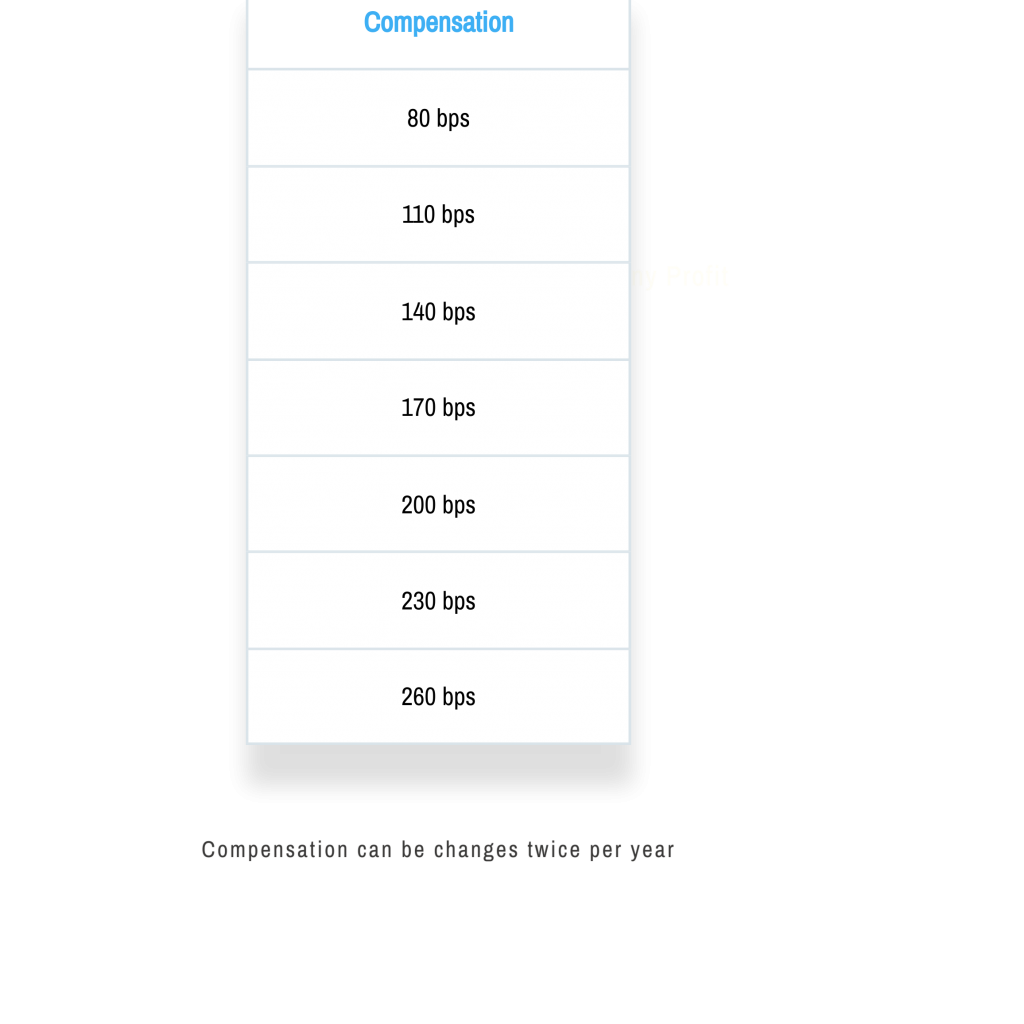

7 Tiers of LO Comp

Choose your comp level

We allow every loan officer to set their own “Par”

Change based on performance

Based on where you’re pricing and locking loans, we allow each loan officer to change their comp 2 times per year

Transparent revenue

Every loan officer can see all of the revenue and expenses on each loan to make educated business decisions. There are NO subsidy requests

Let's journey together

Our 6 Streams of Income

At Clear Mortgage, we have 6 main streams of income that our sales team can take advantage

Commission

Your standard commission for closing and funding mortgage loans. We have 7 comp levels to choose from.

Overrides

Your leadership overrides on your branch or other team recruits

Salary

As a branch manager, you are able to put yourself on a salary.

Bonus

Receive Bonuses for achievements.

K1 Distribution

True partnership k1 distributions. As you close loans, you have the opportunity to vest into ownership

Clear Life Recruiting

As you build and recruit others into the company you benefit.